The payments ecosystem in India has witnessed a remarkable growth in recent years with digital payments now accounting for 99.8% of total payment transactions volume in the first six months of 2025. Digital payments now account for 97.7% of the total payment transaction value during the period, as per data released by the Reserve Bank of India ( RBI).

The total payment transactions during the period amounted to Rs 1,572 lakh crore, out of which, Rs 1,536 was transferred as digital payments.

In 2019, digital payments accounted for approximately 96.7% of the total payment transactions by volume and 95.5% by value. However, in 2014, these figures had risen to 99.7% in terms of volume and 97.5% in terms of value.

UPI vs RTGS

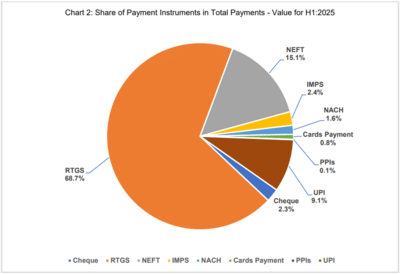

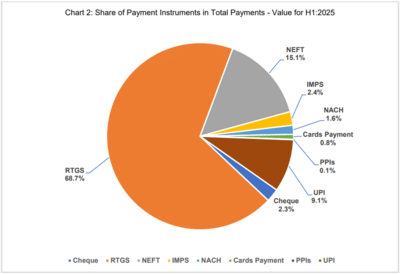

In the first six months of 2025, UPI accounted for the largest share at 85% of transactions in terms of volume, while it had only 9% share in transactions by value.

Meanwhile, Real Time Gross Settlement (RTGS) system recorded the largest share of 69% in terms of value, while it accounted for the lowest share of 0.1% in terms of volume.

RTGS, being India’s primary large-value payment system, registered a volume growth of from 14.8 crore in CY 2019 to 29.5 crore in CY 2024, while transaction value increased from Rs 1,388.7 lakh crore to Rs 1,938.2 lakh crore during this period.

This is because UPI processes a very large number of small-value transactions, resulting in a high share in terms of volume, but a relatively lower share in terms of value. Meanwhile, RTGS, also called the wholesale payment system, contributes higher in terms of transaction value since it has a band of minimum transaction amount of Rs 2 lakh.

Large Value Payment Systems (LVPS) in India include RTGS and systems operated by Clearing Corporation of India Limited (CCIL).

In recent years, the CCIL transactions have observed an increasing trend with an increase 35 lakh in CY 2019 to 45 lakh in CY 2024 in terms of volume. However, in terms of value, they increased from Rs 1,270 lakh crore to Rs 2,780 lakh crore during this period. During the first half of 2025, a total of 28.8 lakh transactions of value Rs 1,734 lakh crore were recorded.

RBI also noted that the Government Securities market has experienced a notable expansion from a value of Rs 769 lakh crore in CY 2019 to Rs 1,812 lakh crore by CY 2024. In 2024, transaction volume also increased from 13.76 lakh in 2019 to 17.6 lakh in 2024. During H1 2025, a total of 9.85 lakh transactions with a total value of Rs 994 were processed.

Meanwhile, forex clearing transactions grew from 16.6 lakh transactions worth Rs 466 lakh crore in CY 2020 to 26.3 lakh transactions amounting to Rs 885 lakh crore in CY 2024. In the first sex months of 2025, these transactions amounted to Rs 682 lakh crore in value.

In the last decade, digital transactions have increased 38 times in volume terms and more than three times in value terms, RBI said in its 'Payment Systems Report'. The CAGR for the decade ending 2024 was 52.5% in terms of volume and 13% in terms of value.

In the last five years, digital payments in India have increased 6.6 times in volume and 1.6 times in value. This amounts to a five-year CAGR of 46% in terms of volume and 10% in terms of value.

The digital payments ecosystem in India comprises of a variety of diverse payment options including credit and debit cards, UPI, IMPS, NEFT, RTGS, digital and mobile wallets, net banking, etc.

The total payment transactions during the period amounted to Rs 1,572 lakh crore, out of which, Rs 1,536 was transferred as digital payments.

In 2019, digital payments accounted for approximately 96.7% of the total payment transactions by volume and 95.5% by value. However, in 2014, these figures had risen to 99.7% in terms of volume and 97.5% in terms of value.

UPI vs RTGS

In the first six months of 2025, UPI accounted for the largest share at 85% of transactions in terms of volume, while it had only 9% share in transactions by value.

Meanwhile, Real Time Gross Settlement (RTGS) system recorded the largest share of 69% in terms of value, while it accounted for the lowest share of 0.1% in terms of volume.

RTGS, being India’s primary large-value payment system, registered a volume growth of from 14.8 crore in CY 2019 to 29.5 crore in CY 2024, while transaction value increased from Rs 1,388.7 lakh crore to Rs 1,938.2 lakh crore during this period.

This is because UPI processes a very large number of small-value transactions, resulting in a high share in terms of volume, but a relatively lower share in terms of value. Meanwhile, RTGS, also called the wholesale payment system, contributes higher in terms of transaction value since it has a band of minimum transaction amount of Rs 2 lakh.

Large Value Payment Systems (LVPS) in India include RTGS and systems operated by Clearing Corporation of India Limited (CCIL).

In recent years, the CCIL transactions have observed an increasing trend with an increase 35 lakh in CY 2019 to 45 lakh in CY 2024 in terms of volume. However, in terms of value, they increased from Rs 1,270 lakh crore to Rs 2,780 lakh crore during this period. During the first half of 2025, a total of 28.8 lakh transactions of value Rs 1,734 lakh crore were recorded.

RBI also noted that the Government Securities market has experienced a notable expansion from a value of Rs 769 lakh crore in CY 2019 to Rs 1,812 lakh crore by CY 2024. In 2024, transaction volume also increased from 13.76 lakh in 2019 to 17.6 lakh in 2024. During H1 2025, a total of 9.85 lakh transactions with a total value of Rs 994 were processed.

Meanwhile, forex clearing transactions grew from 16.6 lakh transactions worth Rs 466 lakh crore in CY 2020 to 26.3 lakh transactions amounting to Rs 885 lakh crore in CY 2024. In the first sex months of 2025, these transactions amounted to Rs 682 lakh crore in value.

In the last decade, digital transactions have increased 38 times in volume terms and more than three times in value terms, RBI said in its 'Payment Systems Report'. The CAGR for the decade ending 2024 was 52.5% in terms of volume and 13% in terms of value.

In the last five years, digital payments in India have increased 6.6 times in volume and 1.6 times in value. This amounts to a five-year CAGR of 46% in terms of volume and 10% in terms of value.

The digital payments ecosystem in India comprises of a variety of diverse payment options including credit and debit cards, UPI, IMPS, NEFT, RTGS, digital and mobile wallets, net banking, etc.

You may also like

"People of Bihar call them Lathbandhan": PM Modi takes jibe at Mahagathbandhan

Dubai to get 40,000 new luxury homes in Emaar's latest Dh100 billion 'Dubai Mansions' project

Karan Johar 'deeply hurt' by Ibrahim Ali Khan? Here's the Bollywood buzz over IAK's 'really bad' comment

Bengal: BJP infighting erupts over attack on CAA camp

Woman glasses pregnant friend in rage at her going to bed early