Mumbai: Spending on credit cards and fresh card additions hit record highs in September, central bank data showed, reflecting the combined impact of festivals and the biggest across-the-board cuts in producer taxes on domestic consumption.

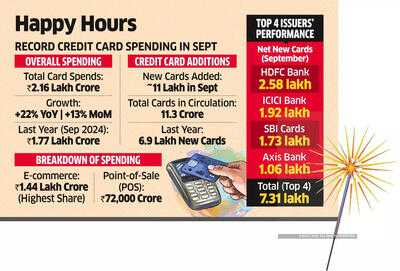

Total monthly card spends crossed ₹2.16 lakh crore, translating into on-year growth of 22% and sequential growth of 13%. Credit card spends had clocked ₹1.77 lakh crore in the same month last year.

Spending on e-commerce websites was the highest - at more than ₹1.44 lakh crore. Spending through point-of-sale devices was more than ₹72,000 crore.

"The surge in high-ticket festive purchases through credit cards reflects a growing affinity towards value and convenience," said Santosh Agarwal, CEO, Paisabazaar. "Consumers are using credit cards more strategically, timing their big-ticket buys to coincide with festive season deals and card-specific rewards."

From September 22, prices of consumption goods across the spectrum were drastically reduced after the Centre slashed GST slabs, and brought most items to lower GST bands.

From September 22, prices of consumption goods across the spectrum were drastically reduced after the Centre slashed GST slabs, and brought most items to lower GST bands.

Meanwhile, fresh credit card additions neared 1.1 million in September, taking the total credit card tally to 113.3 million. In the same month last year, less than 700,000 cards were added. Credit card spending, which was growing at a tepid pace, gathered momentum in September and is expected to quicken in October aided by the onset of the festive season, attractive e-commerce discounts and retailer-led promotional campaigns, which typically drive a surge in discretionary purchases.

Total monthly card spends crossed ₹2.16 lakh crore, translating into on-year growth of 22% and sequential growth of 13%. Credit card spends had clocked ₹1.77 lakh crore in the same month last year.

Spending on e-commerce websites was the highest - at more than ₹1.44 lakh crore. Spending through point-of-sale devices was more than ₹72,000 crore.

"The surge in high-ticket festive purchases through credit cards reflects a growing affinity towards value and convenience," said Santosh Agarwal, CEO, Paisabazaar. "Consumers are using credit cards more strategically, timing their big-ticket buys to coincide with festive season deals and card-specific rewards."

Meanwhile, fresh credit card additions neared 1.1 million in September, taking the total credit card tally to 113.3 million. In the same month last year, less than 700,000 cards were added. Credit card spending, which was growing at a tepid pace, gathered momentum in September and is expected to quicken in October aided by the onset of the festive season, attractive e-commerce discounts and retailer-led promotional campaigns, which typically drive a surge in discretionary purchases.

You may also like

Money stat showing 53% of Brits don't have 1 key document - how to get it for free

Former MP CM Uma Bharti proposes to give one cow to each 'Ladli Behna' scheme beneficiary

Women's World Cup: Wolvaardt's Ton, Kapp's Fifer Power South Africa To Victory Over England, Into Final (ld)

Hedda ending explained: What happened to Hedda and Eileen?

Keir Starmer crisis laid bare as 'Labour finished for decades'