India’s edtech sector is reeling from a brutal reality check, but Alakh Pandey-led PhysicsWallah is looking to change the tune with its much-anticipated IPO.

The company is on course to become the first Indian edtech startup to hit the public markets, but the moment comes amid a shift in the company’s approach and a change in its test prep strategy.

The PW IPO said to be in the range of INR 4,000 Cr to INR 4,600 Cr isn’t just a test for the company but also for Indian edtech, which has seen a dramatic reversal of fortunes since the fall of BYJU’S and the troubles at Unacademy.

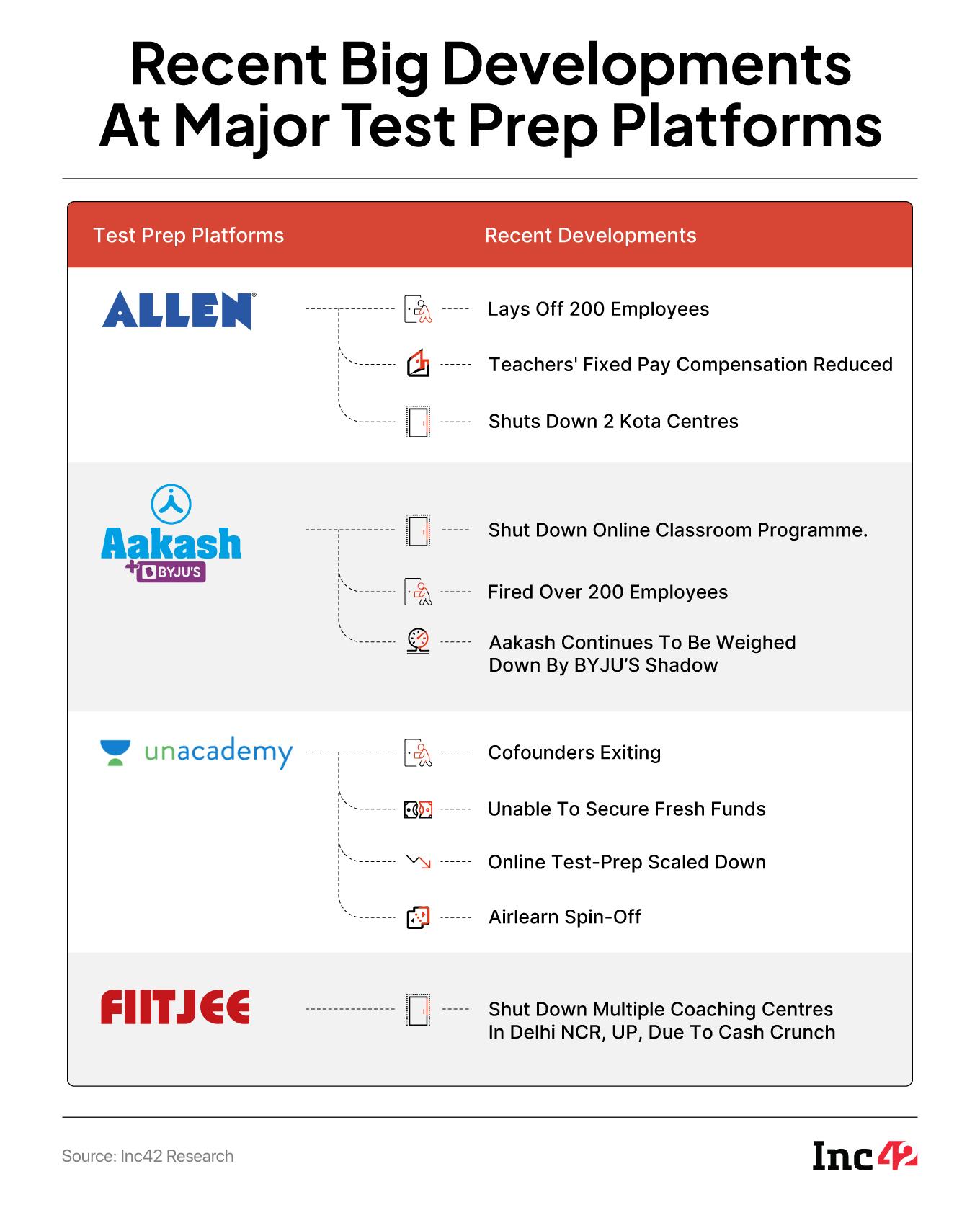

Outside of these edtech giants, dozens of early stage and growth stage startups also shut shop, as the online-first edtech sector shifted to a hybrid future. Despite billions of dollars of funding during the 2018-2021 period, edtech startups just couldn’t eke out profitability.

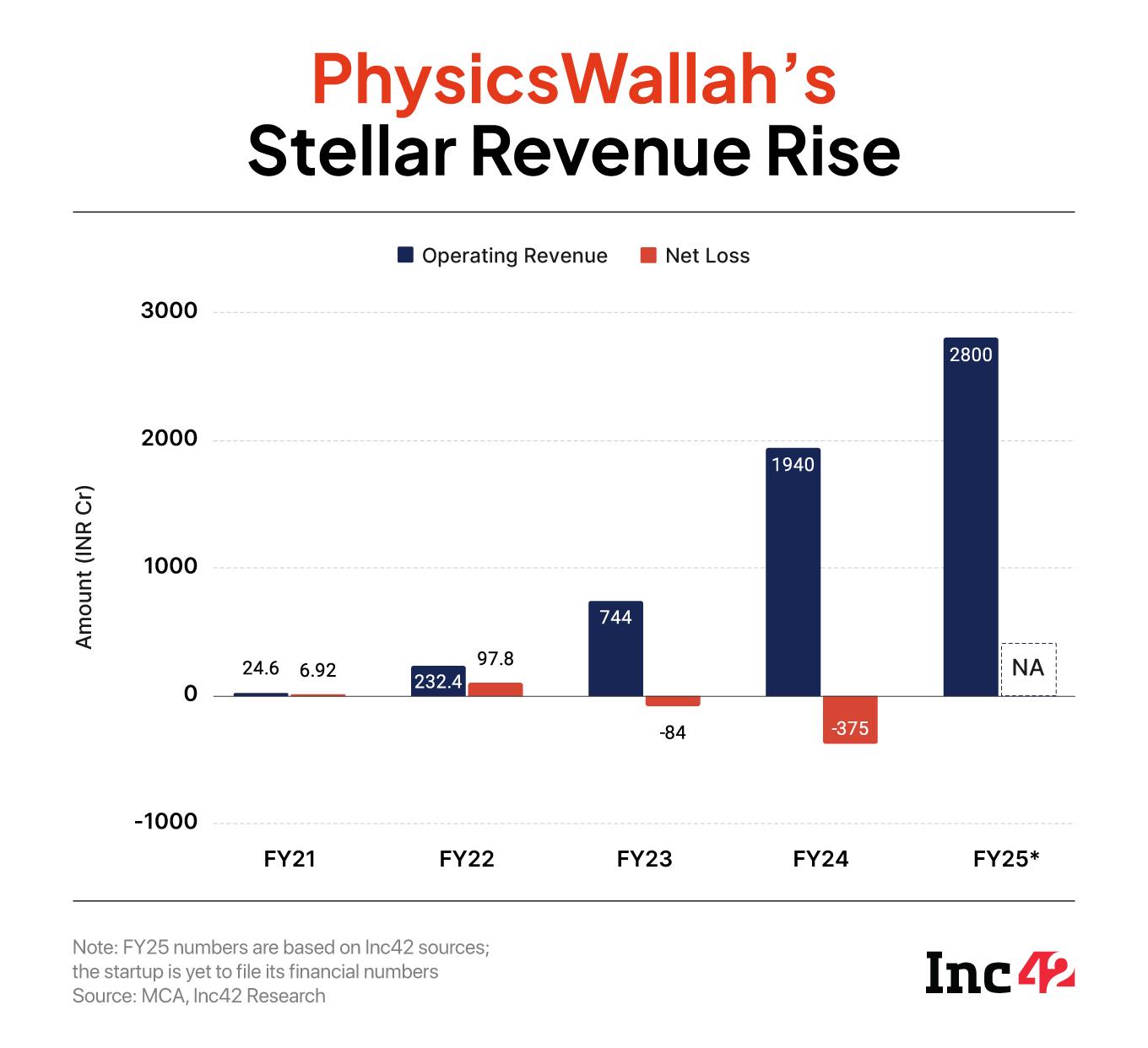

In this context, PhysicsWallah was seen as a ray of hope. Its first major funding round in June 2022 turned it into a unicorn, but unlike others in the sector, the startup was profitable. This immediately set it apart from the rest, but somehow over the course of the last three years, PhysicsWallah has slipped into losses just like the rivals it looked to disrupt.

Its product strategy changed — as we noted in our past coverage — and the company was burdened with customer acquisition costs that took a toll on its bottom line. The rapid expansion into various segments also changed the revenue mix and balance.

But as it builds up to its IPO, PhysicsWallah is looking to clear all nagging doubts. Sources indicate that the company achieved breakeven in FY25, which would certainly be a major feat in edtech and a validation of the company’s approach thus far.

With that said, all is not rosy. The edtech startup, which continues to chase growth aggressively, has had to give up a little bit of what worked for it in the past and as a result runs the risk of slipping back into losses. As we will see, profitability in edtech is not just a matter of creating a flywheel once, but sustaining it year after year.

While the pre-IPO filings with SEBI will clear a lot of these doubts, what’s happening at the edtech unicorn right now? And is PW set to rewrite edtech’s rules again?

PW, which rose to prominence by addressing the needs of students in tier II and tier III cities and smaller towns, is now showing signs of evolving into a profitable revenue machine, one that is more focused on monetisation than it was in its early days.

Earlier, PW carved a niche by solving a problem that most urban-focused edtech startups ignored: accessibility for rural and economically disadvantaged students. Its platform was built in a way that it could support low-data environments, and pricing was deliberately kept affordable.

While the likes of Allen Digital, Vedantu, BYJU’S and Unacademy priced their annual courses between INR 30,000 and INR 80,000, PW zagged and chose the affordable segment for its go-to-market.

PW’s courses were priced at INR 4,000 to INR 5,000, and this was primarily an online business. It’s only after raising funds that PhysicsWallah ventured into high value courses. Initially, the goal for the company was simple: scale through volume and achieve better unit economics.

Since 2022, PW has been in an aggressive stance, acquiring several startups along the way. But with this came rising costs, and for the first time, the startup dipped into the red. In FY23, the startup reported its loss of INR 84 Cr.

Naturally, many asked the question: Is PhysicsWallah just another loss-making edtech startup?

To counter the slowdown and bolster revenue, PW introduced “Infinity Universe” in early 2024, a layered subscription model pitched as an upgrade for an existing course. What was once a simple INR 4,000 base plan now has additional paid tiers: an INR 6,400 “Infinity” plan, and a premium “Infinity Pro” plan priced above INR 20,000.

“They ditched their USP. They were known to offer affordable courses, but since last year, they have been tweaking their prices both online and offline. PhysicsWallah courses aren’t affordable anymore,” said an industry insider who tracks PW closely.

This move seems at odds with the company’s initial strategy. Even as Alakh Pandey time and again reassured students that courses would never cost more than INR 5,000, PW’s pricing strategy was going the other way.

It was a clear attempt to extract a greater wallet share from parents, something several edtech startups tried in the past but failed to realise.

PhysicsWallah declined to respond to questions about its customer acquisition and pricing strategy.

PW’s original model was straightforward but disruptive. It began as a YouTube channel in 2016, with Alakh Pandey as its face. With the help of this channel, Pandey quickly became a household name among JEE and NEET aspirants across India. It was only in 2020, PW was officially incorporated, with Prateek Maheshwari joining as cofounder to manage the business side, while Pandey continued to focus on teaching.

By leveraging a YouTube subscription base of millions of subscribers, PW was able to build its platform with significantly lower customer acquisition cost (CAC), a significant edge in a sector where marketing spends often eat profits. The company’s early growth was largely organic, driven by Pandey’s credibility and mass appeal in the engineering and medical entrance test preparation segments.

However, replicating the same formula beyond the JEE-NEET base has proved to be difficult.

“The Alakh Pandey effect didn’t translate well to other categories,” said one industry insider tracking the company. “A student preparing for JEE or NEET knows Pandey. They trust him. But a CA or UPSC aspirant? They don’t relate to him the same way. His brand doesn’t carry over.”

Post its maiden fund raise, PhysicsWallah aggressively diversified, venturing into UPSC, CA, LLB, and even launching a study abroad platform called AcadFly.

All in all, PhysicsWallah claims to be operating in 37 categories across the edtech space in segments such as test prep, study abroad, K-12, skilling and executive education. But building credibility in all these segments takes time, especially in a category like UPSC and LLB, where an aspirant takes years preparing.

Despite PW’s competitive pricing, aspirants in these segments tend to prioritise ranks, which the startup is yet to deliver in its newer verticals.

In a bid to improve its credibility, PW has shifted to acquisitions. It acquired OnlyIAS in 2022 to enter the UPSC market, and as per media reports, was in talks to acquire Drishti IAS, one of the most recognisable UPSC prep brands. Though those talks fell through, the startup is said to be holding talks with several other UPSC test prep companies, including Chaitanya Academy, Rau’s IAS Study Circle, among others.

While the internal performance in these new verticals remains unclear, Inc42 sources estimated that fewer than 900 students are enrolled in AcadFly.

Besides, the startup has forayed into PW School of Startups, PW School of Innovation, and PW Skills, among others.

“Whatever they saw, they entered. That’s not how businesses are built,” added a founder of an edtech startup.

PW, which built its brand on the back of an online-first model, pivoted to the offline world just like its competitors soon after turning into a unicorn in 2022. Since then, the company has rapidly expanded its physical footprint, now operating more than 250 offline centres across 100 cities. These centres already account for nearly half of PW’s revenue, a strong contributor to the company’s topline and its strategy.

In fact, as per sources, the startup closed its FY25 financials with a revenue of INR 2,800 Cr to INR 3,000 Cr.

The economics of this offline push are telling. While the average revenue per user for online stood at INR 4,000, this number becomes INR 65,000 for offline, more than 16X higher.

It’s a little surprise then that cofounder Pandey has repeatedly stated the company’s intent to open “as many (offline centres) as possible.” The offline model is more lucrative, at least on paper.

It is pertinent to note that high revenue does not necessarily translate into strong profitability. It is a well established fact that offline centres are more capital intensive. From leasing prime rental estate, hiring teaching staff to setting up infrastructure, and spending on marketing, the upfront investment is significant. Moreover, in the early years, these centres often operated at a loss, especially as these platforms offered aggressive discounts to attract new students.

This initial discount-driven growth comes with long-term risks. “The first few months might see packed classrooms due to promotional pricing, but the real test comes two to three years later when fees normalise, ranks are few, and retention becomes harder,” said another industry insider.

Another hurdle is credibility. Unlike incumbents such as Allen or Aakash, which have spent decades building trust, PhysicsWallah is a relatively new entrant in the offline test prep space.

“Established players have structured systems and consistent results. That’s a gap that new-age players like PW still need to fill,” added the insider.

More importantly, even Pandey accepts the financial drag. He has stated publicly that these offline centres typically take three years to turn profitable. This means while the company expands aggressively, its growing network of centres is likely to remain a drag on the bottom line in the near term. This means that there will be a risk of mounting losses, unless it is balanced with a strong performance.

The same can be reflected in the startup’s financial performance. In FY24, the startup’s net loss surged by 4X to INR 376 Cr. Incidentally, this is the same time when the startup laid off over 100 employees.

Another thing to highlight is that PW’s offline courses are primarily focused towards offering classes for JEE and NEET aspirants. However, in the recent past, both these categories have shown signs of saturation or other strain.

Kota, India’s coaching capital, where PW opened its first offline centre in 2022, witnessed a sharp 40% drop in student enrollment last year. Other startups and established players have suffered just as much as PW in this regard, but it shows that traction is slowing down across the industry. As per sources, PW saw 15-20% decline in student enrollment in Kota.

With demand plateauing in its core segments, PhysicsWallah can no longer afford to rely solely on JEE and NEET to scale its offline business. Offline diversification into other categories is necessary. As per sources, JEE and NEET continue to contribute around 60% of the consolidated revenue.

As PW tries to scale offline, it must avoid the same pitfalls as BYJU’S and Unacademy, both of which pursued offline growth aggressively, only to face several financial challenges later. As it stands today, PW’s offline play is a high-risk, high-reward, and the next three to four years will determine whether it can pull it off without bleeding too heavily, especially when it is a public company and faces public scrutiny.

While insiders expect that PhysicsWallah’s IPO will see a strong response, no one knows how public market investors think about the edtech sector.

So the question to ask is, can PhysicsWallah convince Dalal Street and tech retail investors a thing or two about how to evaluate edtech businesses? Even so, concerns about its long-term sustainability will linger on given the company’s up-and-down profitability record.

Edited By Nikhil Subramaniam

The post PhysicsWallah’s IPO Test: Can PW Rewrite The Edtech Story? appeared first on Inc42 Media.

You may also like

Katie Price jets to Turkey for more cosmetic surgery as she posts selfie in medical gown

Trump's tariffs leave India's non-leather shoemakers footsore; global biggies brace for Make in India pain

Stacey Solomon's 'pretty and sophisticated' Rolex-inspired watch is finally back in stock

Mumbai: Shatabdi Hospital In Govandi Faces Acute Shortage, Patients Forced To Buy Basic Medical Supplies

Man Utd news LIVE: Sesko debut date, £104m Baleba decision, Donnarumma talks