Spinny has spun off a narrative that India’s largely fragmented market of clunkers and trade-ins is on a swing.

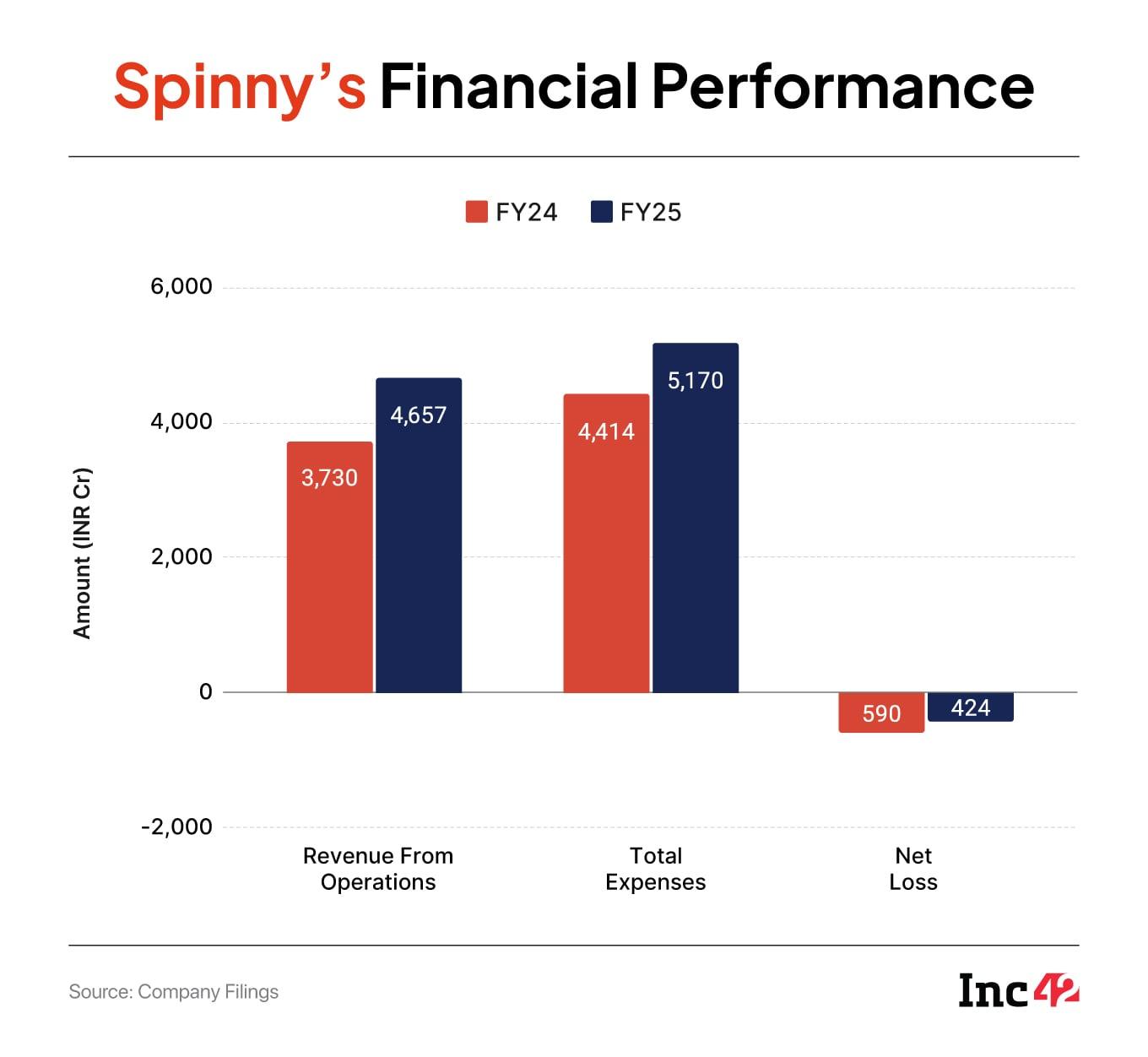

The full-stack used-car platform last week saw its FY25 topline zoom 25% to INR 4,657 Cr, while it slammed the brakes on its losses from skidding beyond 28% at INR 424 Cr. This was the second straight year for the company to cut down on losses.

Although most new-age tech platforms are deep into the red and struggling to set the unit economics after raising capital in quick succession, the financials for the last fiscal tell a different tale. While Car Dekho hopes to rebound in FY25, Cars24 promises to keep up the revenue momentum.

In fact, a look into the used-car startup segment shows that all roads now lead to Dalal Street. Spinny and its peers like CarDekho and Cars24 plan to go public by the year-end or next year, while listed rival CarTrade recorded an 85% surge in profit for FY25.

As the used-car market paced up, investors jumped to hitch a ride down the fast lane. Spinny has raised over $664.20 Mn till date from investors like Tiger Global, General Catalysts, Abu Dhabi Growth Fund, Accel Partners, and Avenir Growth Capital. The used-car marketplace was valued at $1.7 Bn – $1.8 Bn when it closed its $170 Mn Series F round in June this year.

In the turnaround tale for startups in India, Spinny throws up a critical question on the sustainability of its inventory-led model. Inc42 took a look at the company’s playbook to understand how it managed its losses while improving its topline and assesses how sustainable the model is before Spinny rolls out its public float.

Leashing Losses, Revving Up RevenuesWhen Spinny began scaling in 2019-21, its business model seemed too capital-heavy to succeed. Unlike asset-light classifieds businesses like CarDekho, OLX and CarWale, Spinny purchases the cars, builds its own inventory, refurbishes the vehicles, and resells them while claiming to have its cars go through a 200-point inspection and a money-back guarantee.

This solves the consumer’s trust deficit, but locks up enormous working capital, besides raising the operational cost. This led to the ballooning of Spinny’s losses to INR 820 Cr in FY23. The used car retailer has since pulled the leash on its expenses while the demand for used cars on the marketplace kept picking up.

The company narrowed its net losses by a cumulative 48% to INR 424 Cr in FY25, despite aggressive expansion in a capital-intensive sector. This improvement was driven by a combination of revenue growth – up 43% from INR 3,260 Cr in FY23 to INR 4,657 Cr in FY25- and disciplined cost management, where total expenses grew at a slower rate than the 23% topline surge.

Its asset-heavy vehicle procurement process, however, continues to be a drag on its bottomline, with the cost to procure goods rising 23% to INR 4,304.4 Cr in FY25 from 17% rise a year before. Procurement cost makes up around 80% of the company’s total costs. While absolute spends rose with scale, efficiencies in sourcing, inspections, and turnover reduced it as a percentage of revenue.

Spinny also significantly reduced its marketing spends from INR 424 Cr in FY23 to INR 125 Cr in FY25, bringing down the customer acquisition cost. FY25 saw the platform using its operating leverage for the first time. Despite the core operations still sensitive to heavy costs, Spinny tightened its budget in the marketing vertical with the promotional costs easing 13% on-year to INR 123.4 Cr from INR 141.4 Cr.

Around 77% of its customers came through digital channels in the first few months of FY25, which was a slight improvement from FY24. On the employee expenses side, the platform reduced costs by 13% to INR 338 Cr from INR 392 Cr.

Spinny saw some revenue concentration with rising demand for compact SUVs that turned out to be a top pick for women buyers. Spinny Capital, its nascent non-bank finance arm, is also expected to drive additional demand through easy financing. Its higher-margin services such as insurance, extended warranties, and financing also made substantial progress. While still a smaller slice of revenue, these services improved the gross margin per vehicle and reduced reliance on wafer-thin resale spreads.

Despite the tightened fiscal control, Spinny continues to grapple with losses. For a firm widely considered an IPO candidate, the market will expect a faster way to profitability.

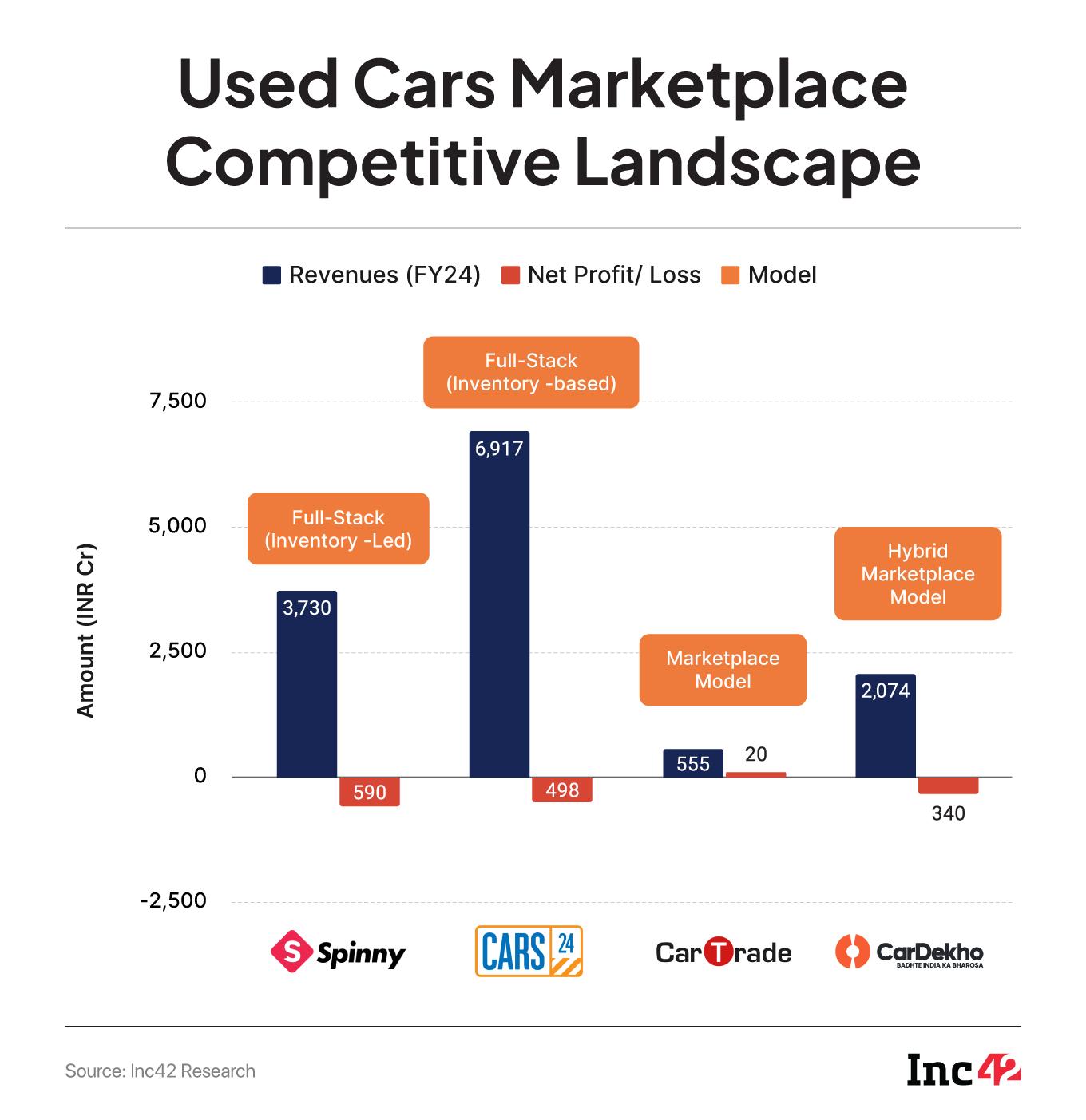

A Rearview Look At The RivalsThe used-car market is a four-way race, where Spinny takes on more solvent rivals like CarDekho, Cars24, and the listed veteran CarTrade Tech.

Its FY25 (or of FY24) performance shows that though the business momentum has picked up, profitability remained elusive. As the market dynamics unfolded, this industry saw two business models emerge – inventory-heavy full-stack car retailer and services platform and a purely ecommerce platform with classifieds and finance options.

Cars24, a Delhi-based platform, is Spinny’s closest rival in scale and strategy. It also takes ownership of vehicles and positions itself as a full-stack player. In FY24, Cars24 reported a revenue of INR 6,917 Cr, which was more than Spinny’s, but suffered steep losses.

Its global footprint, spread to Australia and the UAE, adds to complexities and capital burn for Cars24. The FY25 filings are awaited, but early indications suggest that while Cars24 retains the scale, it has yet to show the same degree of operating discipline that Spinny showed. In FY24, the company’s revenue shot off 25% to INR 6,917 Cr. But, while Spinny trimmed its losses, Cars24 saw its net losses swell 7% to INR 498 Cr.

Ancillaries like warranties and parking fees juiced its topline, but CFO Ruchit Agarwal admitted heavy tech spends pinched the margins.

Jaipur-based used-car unicorn CarDekho blends classifieds with financing through Rupyy and insurance through InsuranceDekho. Its FY24 revenue soared 54% to INR 2,074 Cr, fuelled by a 15% share of the used-car finance market. Its losses dipped 40% on-year to INR 340 Cr, thanks to AI-driven underwriting and fleet bets like Carrum.

Although smaller than Spinny’s scale, CarDekho’s tech-heavy emphasis is likely to deliver wider margins, with the company claiming standalone profitability. Its classifieds-heavy model risks slower growth against Spinny’s full-stack D2C fortress. CarDekho’s agility is its ace, but scaling without ownership of the fleet remains a challenge.

Mumbai’s CarTrade Tech has crossed the profitability hurdle. While its FY25 revenue reached INR 711 Cr, growing 28% on-year, net profit exploded nearly sixfold to INR 145 Cr. Trading at 5.2 times the book value, CarTrade’s profitability shows the asset-light model can drive profits sooner than the full-stack option. Its scale, however, remains much smaller and risks losing loyal customers to platforms that own vehicles and enjoy greater customer confidence.

Rough Ride For Used Car StartupsAlthough used cars outnumbered the sale of new vehicles in FY25, with 5.5 Mn pre-owned units going back on the road, as against 4.6 Mn going ex-showroom, the industry is likely to grow at 8-9% in FY26 from 10% in the past few years, according to a report by Crisil Ratings. The report maintained that the long-term outlook for the sector remained strong.

It has always been a bumpy ride for the used-car market in India, with significant operational, regulatory, and market-specific hurdles impacting both inventory-led, full-stack platforms like Spinny and Cars24 and asset-light marketplaces such as CarDekho and CarTrade Tech. These challenges, rooted in the fragmented nature of the market and regulatory complexities, increase costs, delay transactions, and complicate scalability with unorganised players still controlling 70% of sales.

For platforms like Spinny and Cars24, the vehicle sourcing process is fraught with risks because of anomalies in the paper trail and hidden issues like accident histories and odometer tampering that lead to high rejection rates.

The onus of refurbishment, including mechanical repairs, cosmetic fixes, and compliance upgrades, potentially adds to the vehicle’s cost, with expenses for parts, labour, and logistics eating into the margins.

Asset-light platforms like CarDekho and CarTrade Tech avoid direct procurement, but face challenges in ensuring reliable supply for their listings. They rely on sellers to upload vehicle details, which often leads to inaccurate information on car condition, ownership history, and pricing.

Unlike full-stack models, marketplaces do not control the vehicle quality, which may erode the trust factor for a car buyer. The buyer has additional liabilities for technical inspections and car health check-ups that are carried out through third-party vendors.

The pre-owned marketplace startups have an edge in cities where they are more scalable because of efficient logistics and car sourcing options, compared to what Tier II or III towns and rural markets offer.

In India, the car licence transfers, especially for pre-owned vehicles, is often time-consuming. It is manual in most states, calling for physical visits from the Regional Transport Offices (RTOs) and coordination with sellers.

While full-stack used-car platforms bear the full weight of licensing transfer complexities as they take ownership of vehicles, inefficiencies or delays in obtaining regulatory approvals lock up inventory, inflating holding costs and impacting margins.

Under a marketplace model, though the onus of the registration process lies on buyers and sellers after handover, as laid out in the deemed ownership rules introduced in 2023, they still face indirect liability. Incomplete or delayed transfers can result in sellers (or platforms, if facilitating) being held accountable for fines, accidents, or challans (traffic violations) post-sale, with penalties.

RTO registration is another critical hurdle for full-stack platforms, as they must re-register vehicles under their name before resale. This involves paying registration fees (INR 5,000-20,000, depending on the type of vehicle), road taxes, and ensuring compliance with emission norms like BS4 or BS6.

For interstate sales, hypothecation clearances – when the vehicle is under a loan – and tax adjustments add further delays and cost, often forcing the platforms to maintain larger inventories and, consequently, increasing working capital needs.

The E20 mandate, which stipulates the use of 20% ethanol-blended petrol from next year, may throw up yet another challenge for inventory-heavy platforms. Most of the cars are pre-2023 vehicles and a majority of those are not E20-compliant. Retrofitting these vehicles, which involves upgrading fuel pumps and injectors, come with additional costs, while non-compliant vehicles face lower resale value due to reduced efficiency and potential engine corrosion risks.

Platforms like Spinny and Cars24 may have to discount older stock or absorb the enhanced cost, sacrificing margin erosion.

Asset-light platforms are though less exposed to inventory write-downs, but face challenges in maintaining listing quality.

The Crisil report pointed out the high operational cost from refurbishment, logistics and financing would lead to cash burn, but strong revenue growth is expected to drive breakeven at the operating profit level. Until then, the credit profiles of players will depend largely on fundraising and liquidity to support growth.

Drive Set For Dalal StreetAs Spinny, Cars24, and CarDekho prepare for their listing by late 2025 or 2026 with a target toraise more than $1 Bn, the public market will scrutinise their ability to navigate these challenges while delivering sustainable growth and profitability.

Full-stack platforms like Spinny may attract higher valuations, thanks to its control over the customer journey and trust-building mechanisms such as quality inspections and warranties. Their cash-guzzling procurement and exposure to ethanol-related inventory risks may, however, dampen investors.

Asset-light marketplaces like CarDekho, with leaner operations and higher-margin services, may bank on the success of CarTrade Tech, but scaling their revenues would face challenges.

New car sales crossed the 1 Mn mark in the first quarter of FY26 for the second time in the last two years, but sales slowed down in the later part of the quarter, amid headwinds from price hikes and EV adoption. Will the IPO market favour platforms that demonstrate disciplined cost management and show consistent topline growth? Robust macro fundamentals and solid policy support, backed by controlled geopolitical unrest, hold the answer.

[Edited By Kumar Chatterjee]

The post Spinny’s Pre-IPO Makeover & India’s Used Car Market Conundrum appeared first on Inc42 Media.

You may also like

"Intentional attack on press freedom is an attack on democracy": V Prem Shanker on Puthiyathalaimurai blackout

'We didn't take responsibility': Harmanpreet Kaur blasts top order after India's shock loss to South Africa

Delhi HC grants anticipatory bail to Big Boss fame Ajaz Khan

Netflix's The Woman in Cabin 10 sees Keira Knightley shine in tepid yacht thriller

Israel agrees to end brutal Gaza war after 734 heartbreaking days