Dear reader,

Rapido’s attention is somewhat divided. The unicorn’s foray into food deliveryhas been coming for months. But even as Rapido looked to build this new business, its ride-hailing core is going through the same scaling-up pains.

From concerns about safety to allegations of price gouging to several flare-ups between drivers and customers to complaints about the support and resolution process, Rapido’s current state looks eerily similar to Ola Cabs and Uber.

As Rapido has grown its market share in the ride-hailing business in autos and taxis — adding to its bike-hailing dominance — it needs to address these concerns before it dives deep into food delivery, another business that requires a similar high-touch customer service.

With revenue expected to breach INR 1,000 Cr and profitability on the horizon, this is not an area that Rapido can leave unaddressed for much longer. And while the company has consistently stated that customer safety and driver welfare is a priority area, a big shift is needed.

And now that the company is said to be preparing for a mammoth $550 Mn round, customer experience and driver management will become more pertinent than ever.

Let’s see if Rapido is ready, but first a look at the top stories from our newsroom this week:

- Inside Pepperfry’s Distress Sale: Once valued at about $350 Mn, Pepperfry is now being acquired in a distress sale. The deal, valued between INR 800 Cr-INR 1,000 Cr, comes as the startup struggled with high-cost imports, offline expansion, premium pricing and stiff competition.

- Ultraviolette’s Pivot: Struggling with lukewarm sales and slow registrations, Ultraviolette is now shifting from premium high-performance EV bikes to more affordable to directly compete with the likes of Oben, Revolt and other traditional motorcycles in the country.

- Amazon’s Quick Commerce Push: Amazon has launched its 10-minute delivery service, Amazon Now, in Mumbai ahead of the festive season, aiming to cross-sell to Prime users and consolidate household spending. With plans for 300 dark stores by year-end, the ecommerce giant faces a tough execution challenge against established quick commerce rivals.

Rapido’s current issues don’t just pertain to customers or passengers, but also drivers.

A Rapido customer’s experience with an auto driver in Bengaluru over a fare dispute in June 2025 was fairly well reported, but such disputes occur more often than one might come across on mainstream media.

Just search for user reviews of Rapido on Reddit or Twitter, and there are umpteen posts about unruly exchanges between the driver and the customer, allegedly intoxicated drivers, dispute over pricing or AC within a car and more. All of this sounds very similar to past incidents at Ola, Uber India and other ride-hailing platforms.

A more recent social media post from an unconfirmed Rapido driver alleges he was suspended for asking questions about driver concerns on Twitter. And of course, several drivers have alleged that despite the zero commission model, Rapido does not step in to resolve issues that drivers face on the road, such as blocked roads and other on-ground challenges.

Just from consumers — according to the National Consumer Helpline (NCH) data — as many as 575 complaints were filed against Rapido between April 2023 and May 2024. This number more than doubled to 1,224 between June 2024 and July 2025.

In one such complaint, in August 2025, the Central Consumer Protection Authority (CCPA) slapped Rapido with a fine of INR 10 Lakh for ads promising an autorickshaw in 5 minutes or INR 50.

It’s a minor penalty for the company given its revenue scale, but the complaints cut across billing disputes, refund failures, safety concerns, and deceptive ads. And this has the potential to snowball into something bigger.

Inc42 reached out to Rapido with questions about many of these concerns, however, the company declined to respond.

However, in a conversation earlier this year with Inc42, Rapido cofounder and CEO Aravind Sanka said the company takes safety very seriously at the management level. “Every month, we track and review the number of incidents. We’ve implemented several measures, including pre-ride document checks, background verification, and real-time speed monitoring. If riders cross a set speed limit, they receive a warning. Repeat offences lead to deactivation from the platform.”

Despite these efforts, the problems continue to grow.

The Big Red FlagsMost concerningly, safety issues are a recurring complaint from users and reputation goes a long way in ride-hailing.

“The rider showed up on a different bike […] he started asking personal questions and even touched my leg… Rapido seriously needs to vet their drivers better,” one Rapido user wrote on Reddit.

In another incident, a driver allegedly diverted a passenger into a deserted area at night, raising grave security concerns.

In both cases, Rapido’s customer support was blamed for being slow and inefficient. The heavy dependency on chatbots and automated responses creates dead ends instead of solutions, customers claimed.

“I can’t even call customer care… need to play around [engage] with their bot for 5 mins… chat closes without solving the problem,” a customer said.

Another customer said that he sent an email to the company, complaining that the driver demanded more than the quoted fare and then threatened him and his family. Upon a lengthy follow-up and bypassing chatbots, an executive said that there was no record of any email.

Such issues are often hard to verify but the sheer volume of complaints is equally hard to ignore.

The road Rapido is taking appears familiar. Ola, once India’s leading ride-hailing company, scaled fast but without safeguards, and the fallout was severe. At its peak, Ola rivalled Uber, fuelled by cashbacks and driver incentives. Yet, safety concerns and poor service eroded trust.

Customers often faced fare discrepancies, forced cash payments, stuck Ola Money balances, and unresponsive support. Complaints piled up: 2,482 lodged with the National Consumer Helpline between April 2021 and May 2022—triple Uber’s. By 2024, another 2,061 grievances followed, citing inflated fares, driver overcharging, and incomplete trips.

The customer complaints meant that relations with drivers also soured, especially as companies focussed on improving per ride profitability. Early incentives once netted them INR 70K–80K a month, but as payouts shrank, incomes halved.

“Rapido, in essence, is different from Ola or even Uber,” a partner at a VC fund that has backed Rapido told Inc42, on condition of anonymity. While the investor admitted there are some standalone issues at Rapido, he added that these are bound to happen with a company that has more than 50 Mn users.

On the customer support from Rapido, the partner quipped that you can’t operate a cost-sensitive ride-hailing service and a 24/7 live customer service centre with hundreds of employees.

Rightly so, according to a Citi Research report, Rapido’s monthly active users have surpassed 5 Cr, higher than Uber’s 3 Cr MAUs. However, should this automatically result in poor customer experience?

The Demand-Supply Dynamics“Marketplace models are bound to face recurring issues, largely because they are the same drivers, operating on different platforms,” a founder of a premium cab service startup told Inc42, requesting anonymity.

He added that the complaints, whether around safety, arguments, or reliability, tend to follow them from one app to another. “The problem isn’t necessarily that these companies are making mistakes, but that the marketplace model itself functions within certain constraints, supply-demand dynamics, user expectations around pricing, and the pressure to scale quickly.”

The supply-demand dynamics, in particular, explain some of the allegations that Rapido has a weak driver background verification process.

Unlike Uber India, which mandates live video verification of drivers every 24 hours, Rapido has no routine checks. As a result, the person driving a Rapido vehicle is not always the same one registered on the platform.

For instance, a 21-year-old Rapido driver from Delhi told Inc42 that his auto-rickshaw is registered under his elder brother’s name, as he has yet to receive his own driver’s license. Because Uber requires daily video verification, he is currently only able to take rides via Rapido.

Despite breaking Rapido’s platform policy, he also alleged that Rapido is unfair to auto drivers.

“At present, Rapido is only profitable for a 3-4 km ride. Anything further than that shrinks our earnings to INR 7-INR 8 per km from about INR 10-INR 15 per km. At this rate, it has now become a little unsustainable, especially given the higher CNG prices,” the driver said, requesting anonymity, given his situation.

Shaik Salauddin, the union head of cab drivers in Hyderabad, told Inc42 that the rates being offered to drivers fluctuate often and drivers don’t know how much they potentially earn every day.

“More than often, it’s seen that the app’s pricing is arbitrary and doesn’t actually relate to ground reality,” Salauddin claimed.

Notably, his union has also recently moved the Telangana High Court, alleging that app-based taxi services are charging fares arbitrarily, putting both drivers and passengers at a disadvantage.

The petition requests that the state government implement uniform fares, ensure the proper installation and verification of taximeters, establish a monitoring system for compliance, and establish a public grievance mechanism for drivers and consumers.

Can Rapido Break Free?Uber CEO Dara Khosrowshahi has recently acknowledged the growth of Rapido and the fact that it is now the number one competitor of Uber, rather than Ola. However, there’s also no denying that the exponential growth has now led to trust and safety issues.

Rapido wanted to break the Uber-Ola duopoly with a more affordable platform for customers and drivers. But this alternative is beginning to mirror the very problems that these companies faced.

To move past this, Rapido needs to go back to its disruptive roots. Rapido is expected to cross INR 1,000 Cr in revenue, Ola and Uber are already clocking around 2-4X of the same, but are still loss-making.

Rapido is confident of turning fully profitable in FY26. It also projects to grow 70% every year in the next two to three fiscal years from here on.

What complicates matters is that Rapido is also at the centre of various state-level blockades on bike-hailing and two-wheeler rides. This could have a cascading effect on other ride-hailing categories.

The revenue diversification through food delivery is a necessary step as the startup is eyeing an IPO within the next two to three years, and needs to push itself to show profits and a future growth trajectory before that comes around.

Going beyond its current scale requires Rapido to take on more differentiated bets. Will that come at the expense of the ride-hailing experience?

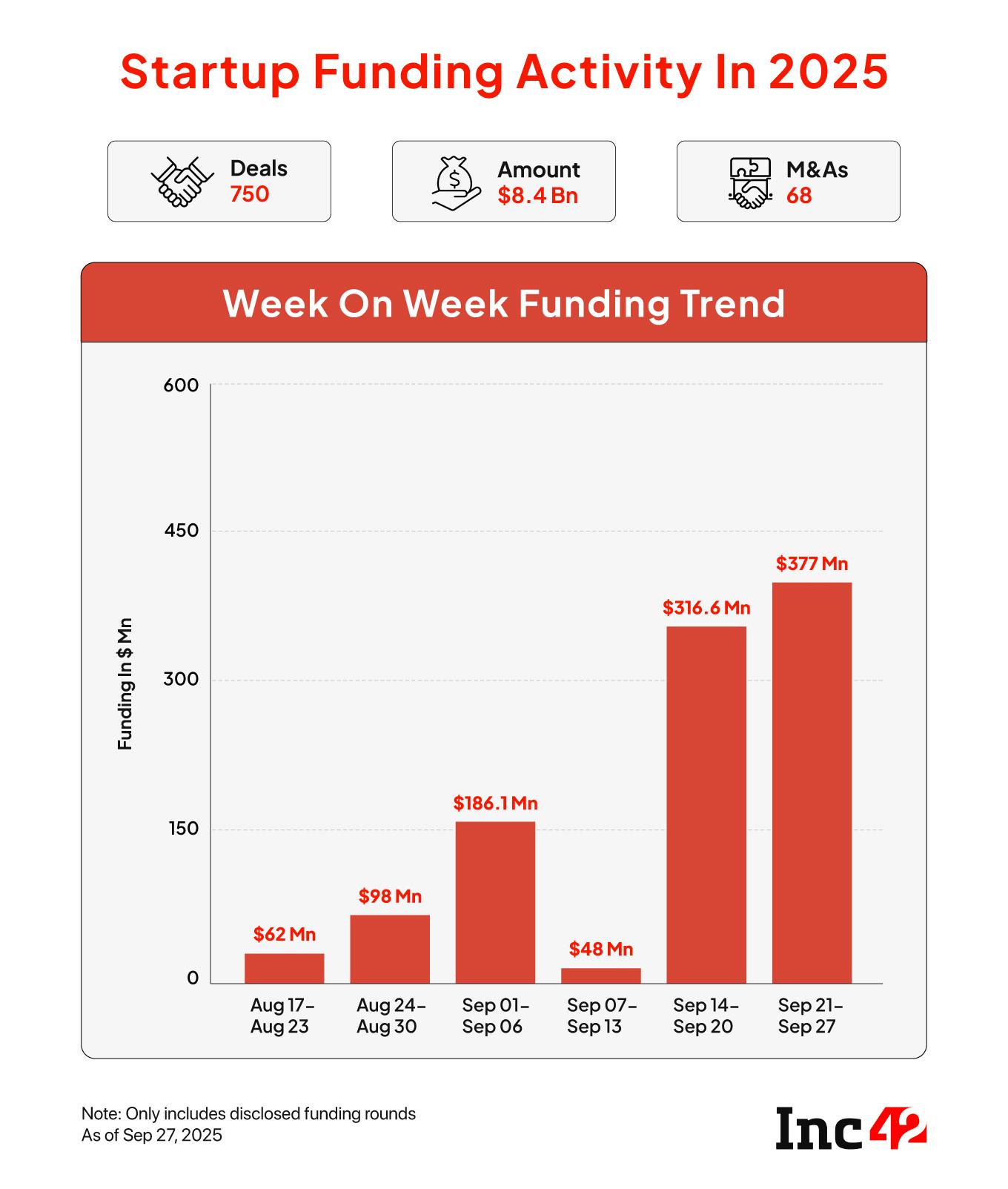

Sunday Roundup: Startup Funding, Deals & More- Raking In Moolah: Indian startups collectively raised $377.4 Mn across 28 deals between September 22-September 27, the highest weekly funding since June this year, and up 19% from the previous week. PharmEasy led with a $191.7 Mn debt round, while AI, foodtech, and ecommerce also saw strong activity.

- Swiggy’s Instamart Hive-Off?: Swiggy has hived off Instamart into a subsidiary while exiting Rapido at the same time. This might be a pivot towards an inventory-led model. However, the move may require new domestic capital to circumvent FDI rules.

- Flipkart Gets Reverse Flip Nod: Ecommerce major Flipkart has bagged approval from the Singapore court to shift its base back to India. This comes as the company is gearing up for a public listing as early as 2026.

- Simpl Ops Suspended By RBI: After the ED crackdown in July, now RBI has ordered BNPL major Simpl to halt its payment operations, due to the latter not having a payments license.

- Nothing Partners Optiemus: Carl Pei’s Nothing is doubling down on India with a fresh manufacturing partnership with Noida-based Optiemus Infracom. The smartphone major is eying to scale up local production for its sub-brand CMF, which was recently spun off to operate as an independent entity.

That’s all for this week. We’ll be back next Sunday with another edition of the Weekly Brief.

Till then,

Lokesh Choudhary

The post The Other Side Of Rapido’s Growth Story appeared first on Inc42 Media.

You may also like

BCCI celebrates India's Asia Cup triumph, announces Rs 21cr prize for team and staff

Govt proposes acoustic alert system for EVs, excluding 2- & 3-wheelers, from 2027

The postcard perfect UK seaside village prettiest in autumn

'OperationSindoor In Sports Too': CM Devendra Fadnavis And DyCM Eknath Shinde Congratulate Team India On Asia Cup 2025 Victory

TUI flight to Cyprus declares mid-air emergency after take-off from UK